I HAD SAID

All that prompted me to embark on writing this book is my past. A past that is neither yesterday nor my childhood! By the past, I mean a time that both I and you, as well as all our ancestors, experienced, and our descendants will share with us and is eternally repeatable. This shared past is the period of our embryonic life, from conception to the moment before leaving the secure and paradisiacal world of the mother's womb and entering this vast and complex world. Perhaps at first, these sentences may seem meaningless to you, and you might believe that nothing remains of it for anyone to remember and write a book now. I express the apparently logical answer to this question by posing several questions; have you ever not been afraid of a very impactful event and later forgotten it? Moments of intense experience when you have felt a great deal of shame, sorrow, anger, or joy in a very short period, have been shocked, and now you don't remember it and sometimes express it in your private psychotherapy sessions without having thought about it beforehand? Despite such capabilities in humans, it is shortsighted to consider the moment of birth as the greatest loss in the history of one's life, suppressed instead of being acknowledged.

Now, another question arises: why is it the greatest loss in the history of our lives? We who have gained life and existence in this world full of beauty? And, of course, full of fear! If we did not lose the paradise of the mother's womb, how could we take advantage of the unlimited possibilities of our vast world, gain experiences, and grow? It is natural that for every gain, we will lose many things, but the nature of this loss is different from other losses in our lives. We have lost the most congruent environment with our inner world and the essential feature of being human, i.e., absolute and unconditional satisfaction of the moment, an environment that is mostly stable, stimulus-free, and completely satisfying.

We came into a world of which we had no prior knowledge, and now, to satisfy our needs, we must seek help from caregivers who may not always be attentive to us, as they are sometimes preoccupied with their own needs and daily lives. We need to recognize that our survival is often dependent on their care and attention.

Survival is indeed the issue that entangles us from the very moment of birth until the moment of death, serving as the foundation for all our behaviors and mental processes.

After entering the complex and vast current world, we realize that we have no knowledge of it, and our only future is death and destruction. How can we not be afraid of jeopardizing our survival when we have no knowledge of our new environment except for its vastness and being bombarded by various strange and new stimuli? This fear is much greater than the upper limit you can imagine; and completely natural! In the end, we take refuge in our first and most powerful weapon, crying.

Crying as our first interaction with the outside world carries a very important message: "I am afraid."

Fear arises when security is compromised. We all seek refuge in someone familiar, a familiar environment, and understandable conditions to escape our fears. A low-level example of this is entering a party. We approach people with whom we feel a greater sense of intimacy rather than those we are meeting for the first time. Similarly, at the moment of birth, the most familiar person, stimulus, environment, and understandable conditions for us are our mother, and in her embrace, we find tranquility. This embrace responds to the message of our crying and says, "Don't be afraid, I am here, I know the world, and I will be by your side."

Whether willingly or unwillingly, we trust this embrace, and alongside it, we get to know the world. The father enters our world, and now, with another caretaker, we have more opportunities to explore the world under their supervision. As we grow older, more people enter this safe zone, and we will understand more situations. Our circle of friends expands, we enter society, and we will deal with norms, cultures, and issues related to any community we find ourselves in, and inevitably, we will conform to them. However, what is always constant in us and our relationships, now unconsciously considered as the first law, is survival.

As we grow older, we become more aware of the importance of money in preserving survival. Of course, money comes after social culture and the culture of using money for social growth. This is because without social relationships, human survival is doomed, and this fact is now clear and obvious to everyone. The survival of society is our survival, and the growth of society is our growth.

Preserving our survival in society requires respecting the culture of that community, and in this way, the culture of each society guarantees its survival. Because if the cultural norms in society lead to its destruction and everyone conforms to them, the result will be nothing but the destruction of that society. Although the culture may be dominant and accepted, if it is wrong, the outcome will be nothing but the destruction of social assets.

The world we live in is a world full of order, rules, and laws that many of them are still not understandable for humans. By accepting this reality, humans have delved into the discovery of knowledge and the understanding of the construction of scientific methods. Science is nothing but the discovery of reality, and for survival and fulfilling its role in every moment of life, humans need it. In this way, in any field that helps humans in understanding their position and growth, there is a scientific field and expertise. We witness that from the beginning until now, sciences are gradually added to these fields.

"In the present era, trading is recognized as a specialized field, and traders, with the aim of improving the quality of their transactions and achieving greater profits with minimal costs, engage in education in this field. Trading without sufficient knowledge and expertise is like other human behaviors, such as driving without knowledge and understanding, ultimately resulting in harm and loss. Just as in all our behaviors, expertise in the specific subject is not enough, in trading, beyond the training in specialized fundamentals, other skills are also required, including emotional control, time management, sociology, and more."

"Although a trader in the trading environment observes the movement of a few candles, they are aware that these candles are the result of decisions made by millions of traders worldwide and are influenced by various political and social events. Nevertheless, traders understand that there is no way to control millions of people and dictate the market according to their desires. It is evident that a trader must begin by controlling themselves first. As the principle of reality dictates, even though the trading community does not operate under their control, they can at least manage their trading behaviors to the best of their ability."

"We know that financial markets, as one of the most profitable methods of making money and generating income today, have gained significant momentum in civilized societies and have their own unique culture. Financial markets consist of a large community of buyers and sellers, and whenever one seeks dominance over the other, the cultural behavior, thinking, and desires of these participants enlighten our trading decisions in the direction of preserving survival and then financial growth, and we must act accordingly."

Now, we turn to the importance of science as the main tool for recognizing reality and the culture of the prevailing society. The scientific and specialized rules of economics and trading help us in this path. With the help of the science and expertise of trading, we will be able to discern whether the current trend is dominated by the desires of buyers or sellers. What measures does the other party in this society contemplate, and what actions are they taking to change the prevailing conditions? Should we align ourselves with the prevailing society, or wait for the results of the other party's actions and join the market when their desires become dominant? The answers to all these questions require expertise in trading and education on the culture of participating in financial markets. Without knowledge of this culture, it is impossible to accompany the dominant society and the clearest future awaiting us is loss and elimination, the loss of all capital."

What creates the movements of extension and contraction, or in other words, the tail and head of financial markets, is the prevailing culture and behavior of traders, whether in line with it or contrary to it.

The lack of knowledge in a specialization and the unfamiliarity with the prevailing culture of experts active in that field is a path that leads to nothing but destruction. This statement is universally agreed upon, yet in practice, we sometimes observe behavior contrary to it, even on a national scale. This is evident in what was observed in the daily chart of the overall index of the Iranian stock market in the month of Mordad in the year 1399 (Solar Hijri). The lack of a culture, the repercussions of which will indirectly affect at least two generations optimistically, will not be released easily.

Iranian stock market in the month of Mordad in the year 1399 (Solar Hijri)

The cultural deficiency created a contrary trend from a correctional movement. The cultural deficiency made the concept of behavioral economics more tangible for us; it's a perceptual error that leads individuals to have a greater inclination toward the results and consequences they achieve in the short term. Our preferences change over time, and when individuals intend to prepare for an unpleasant event without feeling any problem and consider themselves ready for it, about one to two days before the scheduled time, they experience high tension and perceive that event as more imminent. Just like when powerful corrections entered the Iranian stock market, and each bearish candle of that correction created an intolerable tension in traders unfamiliar with the trading culture, leading to decisions that, through a correction and a rise for the continuation of the price growth, created a contrary trend.

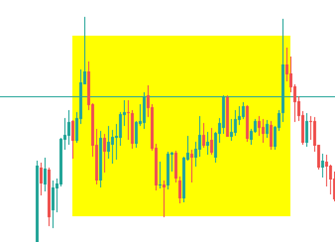

As observed in the image below: The starting step involves small candles, and this is one of the most reliable signs indicating the initiation of liquidity and the accumulation of orders in that price range. Based on this, one can confirm the entry of significant funds in the direction of ascent by large traders; this marks the beginning step.

After the starting step and passing the first tension level, as observed in the image, we don't see any weakness, and it is expected to continue the movement as much as the preceding momentum; however, even after that, it did not show any weakness and covered a broader range, indicating no capital outflow by large traders; the liquidity is still high!

As seen, after that, the price entered a correction phase and, considering its previous momentum, before reaching maturity, it started its next move; liquidity is still high!

Look at the second step; considering the previous step, our expectation was a move to the same extent, but again, no weakness was observed in the trend; the move continued.

Given the images of steps 1 and 2, it can be observed that during both steps, we ultimately see two consecutive red candles. However, what becomes apparent with the arrival of step 2 is that the number of red candles has increased, indicating a sign of the weakening of the movement and a gradual exit of liquidity. In this case, a skilled trader would wait for a price correction.

With the formation of two powerful red candles, a correction begins; this is entirely natural! Every advance requires a retreat.

Since it's not precisely known at which point the correction will occur, a trader should cash out a portion of their position.

Therefore, if the correction reaches maturity, experiences weightlessness, and ultimately the candlestick order flow is observed, one should re-enter the trade. By observing signs of weakness in the downward trend, one can infer that the intention of large capital is to prevent further decline in price.

Weightlessness and the appearance of the order flow candlestick; the lack of necessary trading culture as well!

Despite the weightlessness and the formation of the order flow candlestick, due to the lack of necessary trading culture among non-specialized traders and the prevailing conditions in the market, the price remained unable and unsuccessful in continuing its upward trend. The correction turned into an inability to continue the upward trend, and the downward trend began with the exit of capital; the greatest financial and social disaster of the Iranian stock market in the year 1399 AH.

A little contemplation about the above-mentioned title reveals a point that should have been considered before taking action: thinking before acting. In the science of psychology, there is a very important concept that has been extensively researched, and various manifestations of it are observable in the human world: reactionary behavior.

The term "reactive behavior" is used to describe behavior that occurs before thinking. By "thinking before acting," we mean contemplating all aspects of an issue. If traders unfamiliar with the rules of financial markets instead of merely thinking about their profitability, consider the specialization and systematic nature of the market, at least by consulting with experts in the field—not those who consider themselves experts based solely on their experience in the market for some time—they would enter this domain more wisely and experience the minimum level of loss.

One of the reasons that led non-professional traders in the market to rely on the recommendations of non-professional traders active in this field and make their non-specialized skills their guiding light is their greater familiarity with this environment, albeit through a flawed experience. It's akin to the reassurance message we received at the beginning of our lives in response to our cries from our mothers: "Don't be afraid, I am here, and I know this environment better than you."

But we were no longer infants. We were not passive and imitative. What seemed to be non-professional expertise from rational and mature individuals at that time turned out to be the sweetness of profit. Now, we come to the depth of the meaning of this sentence that in this world, we should not allow our inclinations, needs, and emotions to dominate our skills.

In our vast country of Iran, there is a village named Mal Mala in the Landooh district of the Kohgiluyeh County in the Kohgiluyeh and Boyer-Ahmad Province. According to the 2016 Iranian Census, the village had a population of 513 people. Now, it is known as "Mal Street," the world's only stock market village.

The people of Mal Mala, with complete awareness, were engaging in economic activities, dedicating their businesses to the stock market. In this endeavor, individuals ranging from an 8-year-old child to an elderly 80-year-old man were involved in investing in the market.

What initiated this movement among the people of Mal Mala was the profitability of the accounts of several young individuals seeking growth and success, as well as their introduction of the stock market to the locals. Following that, various media outlets and statements from influential figures endorsed this trend. This movement continued until the destruction of initial capital, the collapse of agricultural and livestock activities of the villagers, the disintegration of families, the complete bankruptcy of many households in the village, and a reduction in hope for life and the mental and economic well-being of the residents of Mal Mala. Now, many know Mal Mala by the name Mal Street, and this name carries a very heavy and detrimental connotation for the entire village and its people.

Throughout Iran, many individuals exist who, on their own, can serve as an example of the significant suffering that the people of Mal Mala talk about; a reactive behavior at the national level! I had heard everything that the chart with the language and literature of chartical factors had said, and all these issues;I had said

Oli price

Zero dollar

By observing the image below, we can see that after a strong downward move, we should expect a correction. The correction, exceeding 50%, indicates that we shouldn't expect a significant further decline.

Although we shouldn't have expected a significant decline, we needed to prepare for an upward movement in price. We know that with the formation of a strong step and its appropriate correction, the end and change of the previous trend occur. However, since this correction was not suitable for its own step and couldn't reach a price higher than the one discovered by its own step, we witnessed an inability to continue the trend and the creation of a pullback complex. The price attempted to reach itself to the higher level or its previous highest figure; we had to be ready for the pullback to the reversal level.

With the formation of the order flow candle, the next decline begins. The first level of tension ahead was the end of the first downward step, where we observed a corrective reaction in that range. The performed reaction did not have maturity in line with this step, and it started to move; the inability to continue the trend was observed.

With the onset of the inability to continue the upward trend and the price movement in the upward direction, if, as in the past, a correction takes place, it indicates the end and a change in the trend, which has happened. In the continuation of the second step, the new trend continued with the formation of small candles, indicating that traders, although not inclined towards further price declines, also have no inclination to increase it. Therefore, with the formation of a powerful bearish candle as the order flow candle, we consider the direction of the price movement to be downward.

Given the second bearish step, it is expected that the price will move to the same extent. This movement, according to the prediction based on the formation of candles and the previous step, will go down to the zero price point.

The price of oil unbelievably dropped to zero dollars!

What is officially recognized is reality, not fantasies and common beliefs. I had heard everything that ChartBaba had said; I had said it.

With a little contemplation on what was mentioned in the analysis of the Iranian stock market disaster, we understand that insufficient understanding of the principles of financial markets and trading culture will lead to results that are sometimes irreparable. Every specialized action requires its own scientific foundation and theoretical basis. Classical finance, as the first creator of the theoretical foundations of trading expertise, examines the past of the market with the most focus on analyzing and justifying price movements. In the path of trading, many methods have come and gone over time to predict future price movements, and some still have their own advocates. What is presented in this volume to explain price movements in any financial chart, whether it be the Iranian stock market, oil, or Bitcoin, is my innovative method, Chartical Jebel Ameli, which has been detailed in previous writings (Sentimental, Chartical Jebel Ameli).

The reason for naming this approach Chartical Jebel Ameli is that it allows predicting the future without the need for any tools, indicators, oscillators, or any of the fundamental and technical analysis methods. It solely relies on an empty chart and the price movements themselves.

Based on and relying on this trading method, it is possible to discern the prevailing sentiment of buyers and sellers in the market and predict the next price movement. However, the story does not end here. There are many issues on the sidelines of buying and selling various symbols in financial markets that impact each other and ultimately affect the price of each stock or symbol directly and indirectly. Declarations of war between countries, changes and decisions of the elected national leaders in each period and their impact on the relations of that country with other countries, as well as the per capita production, exports, and imports of oil and non-oil products of different nations, and the impact it has on the currency of that country and others; unemployment and inflation rates, housing market recession, and so on. All of these are factors that influence the fluctuations of financial markets, and traders, whether willing or unwilling, deal with them and take actions to buy or sell accordingly.

Awareness of these factors and their impact on financial markets has no relevance to traders, and traders make their trading decisions solely by recognizing the various price movements from the formation of the current market candles and their direction. The most interesting part of this discussion and profession is that although traders are not aware of events behind the price and do not have awareness, over time, with the increasing familiarity and attachment they gain with price movements, they can touch and predict some aspects of future changes in the global economy. Like what I, Ahmadreza Jabbal Amoli, predicted before the collapse of the Iranian stock market (with knowledge of the trading culture of my homeland, contrary to what my trading expertise said), the zeroing of oil prices and ultimately the sharp drop in the price of Bitcoin and the economic recession of 2017 before it was mentioned by George Soros and others, which will be discussed, as well as the new upcoming event that is happening and that I will mention.

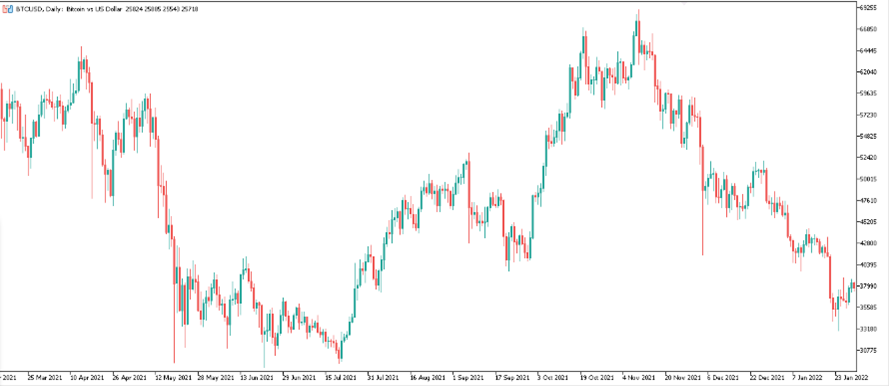

BITCOIN

Starting from April 14, 2021, when Bitcoin, which had started its steep decline, formed a corrective pullback state to the reversal within its $30,000 price range and the inability to continue the downward trend, a new upward trend began with the order flow candle on July 21, 2021.

The powerful step that required a correction, and this correction was in the direction of starting a new step, was in the process of taking shape; every moment in the market requires adjustment and every step in the market requires correction.

Gradually, with the increase in price, more red candles formed in the daily time frame. The profitability skewness of the stocks decreased, indicating a reduced financial commitment from traders in the buying direction.

The price decline began with large candles. Signs of a downward trend were evident based on the step and correction, but the price could not go below a certain level; there was a tendency among large traders for prices to move higher.

Finally, with the formation of the pullback to the reversal, liquidity entered the market in the direction of price increase. The visual appearance of the candles, the absence of any specific weakness in the current trend, and the strength of the previous step, at least, created the expectation among traders that the price would rise to the range of $65,000; the price reached $66,000, but the principles of charticals indicated a heavy decline ahead for this symbol, as evidenced by the following:

Increased Depth

This event was observed on the Bitcoin chart when the second correction in its uptrend had a greater depth compared to its previous correction.

Decreased Launch Distance

The principle of a decrease in launch distance occurs with a reduction in the distance of each peak (in upward trends) and each trough (in downward trends), signaling a warning bell indicating a decrease in the trading power of participants in the trend direction. Observe how the distances between peaks and launch prices have decreased in the recent movements of this uptrend.

Inability to Continue

Trading requires transparency in a trading symbol, and this was clearly observable in the price chart of Bitcoin. In the image below, we will see the inability to continue with full transparency:

Decrease in Skewness Coefficient

With a little contemplation in the image below, we find that the cumulative slope of upward movements has turned towards a downward trend.

Weightlessness and Entry Edge

The manifestation of signs, one after another, and this time the formation of weightlessness at the end of a movement weaker than the previous ones put an end to Bitcoin's upward trend. All signs pointed to the conclusion of a long bullish trend in this symbol, and only the formation of an entry edge was needed to start a significant decline, and that too became apparent.

In the images and details above, we examined the significant decline of Bitcoin, and you can see its overall trend in the following image. Everything that Chartical Jabal Ameli predicted and I had said.

ECONOMIC RECESSION IN 2017

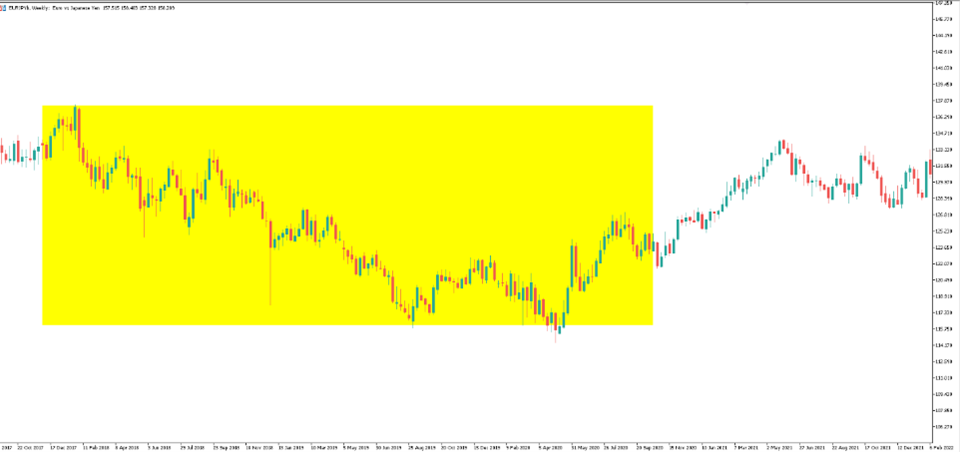

"My analysis and prediction of the economic record were based on the price behavior in the price charts of major currency pairs, global indices, and oil. The mentioned trading symbols, especially the Euro and Dollar, had entered a turbulent price range, indicating a lack of liquidity. A closer look at the specified sections in the price charts reveals a change in behavior during this time period."

EURJPY PRICE CHART

"The Euro value, without a clear basis against the Japanese Yen, which is considered a safe asset, was in a state of decline."

GBPJPY PRICE CHART

USDCAD PRICE CHART

USDJPY PRICE CHART

EURUSD PRICE CHART

USDCHF PRICE CHART

OIL PRICE CHART

GBPUSD CHART

XAUUSD PRICE CHART

"The skill of an experienced trader is not only about trading. A professional trader should be able to recognize such important events in various market cycles, and inform the public and relevant authorities about them. Additionally, they should provide alternative solutions for using trading positions to the community and other traders. I, with the language and literature of Chartical Jabal Ameli, heard the entry into an international economic recession from the price chart of all the mentioned symbols that you saw their image, but it was not heard. Now, with heavy grief and regret, I say:""I had said."

Aristotle believed: Human nature is enduring, not his wealth. If we think back to our school days, we remember a question that was prevalent at that time and was raised in various forums: Is knowledge better or wealth? The answer we often heard was divided into two categories. The first group, according to the approval of the elders, showed their ethical and moral side, and some chose knowledge based on their awareness and knowledge. The second group preferred wealth. They saw wealth as a path to comfort, tranquility, and building their own path of growth and prosperity, affecting their surroundings, culture, and society. Today, with the intellectual growth of societies and the relative overcoming of black-and-white thinking and dualism, we face a confronting response: knowledge is better than wealth. Wealth without knowledge is destructive, and knowledge without wealth will be useless. Now that I have the opportunity, I want to express the main purpose of writing this book with this statement. As I detailed at the beginning of the book, science is nothing but the discovery of reality. The discovery of the direct and indirect relationship between various variables in various fields and areas that help us improve the quality of our individual and social lives. For example, if you study the concept of attachment styles in psychology, you will find that this deep and detailed concept has been studied and investigated in many other concepts in this field, including depression, anxiety, and so on. For example, scientists in this field have found that the likelihood of postpartum depression in mothers whose attachment style is insecure is much higher. With this one-line result, many events fall into place. Therapists in this field, in the course of treating their patients with postpartum depression, focus more on resolving conflicts with insecure attachment styles. Or women who want to accept the role of motherhood will better perform in the process of becoming a mother during pregnancy and the postpartum period by resolving conflicts with insecure attachment styles. The children of these mothers will also be more effective in the more efficient process of their treatment, and their treatment path will be clearer. In this way, the importance of this concept will be emphasized in prenatal education classes, and efforts will be made to prevent the occurrence and transmission of this attachment style as much as possible.

This example was only mentioned to illustrate the role of science in prevention, treatment, and improvement of the parenting process. In all existing fields, science operates in the same way, and scientists also strive in this direction. Now, if we look at science with this perspective, science itself is considered a kind of wealth, and the scientist is wealthy, but on the condition that his knowledge is put into practice. As Saadi says: What remains of the scholar without action? Like a bee without honey.

If we look at science as a wealth on a national and then an international scale, scholars and scientists in each country will be considered national and, perhaps, global capital. Every field of science has its own language and literature, and trading and economics are no exception to this rule. After the economic crisis in the United States, the focus of the government shifted towards finding a way to anticipate, discover, and solve such problems before they occur. Behavioral finance, predicting and explaining prices based on their movements, proved to be more effective than classical finance and gained more attention.

The trading method of Chartical Jabal Ameli is one of the approaches that has proven its effectiveness in behavioral finance. It currently explores its concepts, such as the correlation between the prices of various currencies like Euro-Dollar, Euro-Pound, Euro-Yen, and Euro-CAD, and examines the correlation of the price fluctuations of each of these currencies with others. The concept of trend and its initiation and conclusion signs are scrutinized to gain insights into the liquidity of all financial markets. It also tracks the signs of the entry and exit of large amounts of money into various financial markets.

What is currently observed in the various fluctuations, similar to what was seen in the previous economic recession images above, indicates an entry into a new international and global economic recession in the year 2023. This recession continues, and its end is currently uncertain. The cause of this, for me as a trader and not an economic analyst, remains unclear. Similar to my predictions regarding the Iranian stock market, the collapse of oil prices, the heavy fall of Bitcoin, and the international economic recession in 2017, I am now announcing a new economic recession for the coming months. I urge all economic and capital market analysts to conduct deep and serious research on this matter.

Your statement suggests that, as a listener and translator of the chart language of Jabal Ameli, you have perceived what has been presented as an undeniable reality of the market and the economy. According to your understanding, we are entering a two-month period leading to a global economic recession that will affect all nations.

It seems you express hope that, contrary to your past experiences of being ignored, you can proudly say, "I had said," in the face of the consequences of the international economic recession.