Chartical 2022

Preface

This book has been written with the intention of guiding traders, both beginners and professionals, toward a deeper understanding of the market and the art of trading. In the current financial world, trading has turned into both an opportunity and a challenge; an opportunity for those who are prepared, and a challenge for those who enter without knowledge or strategy.

The purpose of this book is not to provide quick recipes for getting rich, but to present a structured framework, based on years of study, research, and experience, that can help readers take logical and intelligent steps in their trading journey.

This work seeks to strike a balance between theory and practice: on the one hand, it introduces the fundamental concepts of trading and market dynamics, and on the other hand, it provides practical insights and methods that traders can apply in real conditions.

My hope is that this book will serve as a reliable companion for those who want to shape their future through the financial markets and achieve lasting success.

Introduction

The world of trading is one of the most fascinating and, at the same time, the most complex arenas of human economic activity. Each day, millions of people around the globe engage in financial markets, trying to make sense of price movements, market behavior, and economic signals. Some succeed in this journey, while others lose both their capital and their confidence.

The key difference often lies not in access to information—since today, information is widely available—but in the ability to interpret and use that information effectively. In other words, success in trading requires more than just data; it requires vision, discipline, and a well-founded strategy.

This book has been designed to open a window into the nature of markets, the psychology of trading, and the tools available to analyze and interpret trends. Readers will discover that trading is not mere speculation or gambling, but a profession that demands patience, knowledge, and emotional balance.

By reading this book, you will learn about the foundations of financial markets, the principles of technical and fundamental analysis, and the psychological factors that influence decision-making. You will also see how to avoid common pitfalls and how to build a mindset that supports long-term success.

Chapter One: The Nature of the Market and Trading

Trading has always been an inseparable part of human life. From the earliest days of civilization, people exchanged goods and services to meet their needs. Over time, this simple exchange grew into structured markets, and today it has evolved into one of the most complex systems of human interaction: the financial markets.

But what is the true essence of trading in today’s world? Is it merely buying and selling in hopes of making a profit, or does it reflect a deeper phenomenon? To answer this, we must examine both the opportunities and the challenges of trading as a profession.

The Potentials of Trading as a Career

Trading is one of the few professions where the limit of income is not fixed. Unlike traditional jobs, where salary and progress are often determined by predefined structures, a trader has the chance to achieve significant financial freedom. With the right skills, discipline, and tools, a trader can scale income far beyond conventional expectations.

Another unique advantage of trading is flexibility. A trader is not bound by a specific workplace, office, or even geographic location. With access to global markets through online platforms, one can trade from anywhere in the world—whether at home, in a café, or while traveling. This mobility has made trading especially attractive for those who seek independence and control over their own time.

The Benefits of Trading

- Unlimited Earning Potential – Success in trading is not capped by a fixed salary; it grows in proportion to knowledge, strategy, and discipline.

- Flexibility of Time and Place – Unlike traditional jobs, traders can design their lifestyle and daily schedule around their trading.

- Direct Access to Global Markets – With modern platforms, anyone with internet access can participate in financial markets worldwide.

- Independence – Traders rely on their own decisions, strategies, and skills rather than a manager, company, or organizational structure.

The Disadvantages of Trading

Despite its many attractions, trading also has risks and difficulties that should not be overlooked.

- High Risk of Loss – Without proper knowledge and discipline, traders may quickly lose their capital.

- Psychological Pressure – Constant exposure to market fluctuations can cause stress, anxiety, and even emotional exhaustion.

- Lack of Guaranteed Income – Unlike fixed salaries, trading provides no certainty. A trader may experience both profitable months and losing ones.

- Need for Continuous Learning – Markets are constantly evolving. A trader who fails to keep learning will soon fall behind.

Behavioral Finance and Trading Psychology

Trading is not only about charts and numbers. Human emotions—fear, greed, hope, and hesitation—play a critical role in decision-making. Behavioral finance studies the psychological factors that influence traders, and understanding these elements can often be the difference between success and failure.

A professional trader learns to control emotions, avoid impulsive decisions, and follow a predefined strategy. In contrast, amateur traders often fall into emotional traps, such as holding on to losing trades due to hope, or selling too early because of fear.

Passion, Not Just Need

Many people enter trading with the sole motivation of making money. While financial gain is a natural goal, true success usually belongs to those who are genuinely passionate about the art of trading. Passion drives patience, commitment, and the willingness to endure hardships. Without passion, trading can feel like a burden and often ends in disappointment.

Required Capital

Another essential question for beginners is: How much capital do I need to start trading? The answer varies depending on the market and trading style, but one principle is universal: only risk the money you can afford to lose. Trading with borrowed money or essential funds (such as living expenses) is a recipe for disaster. A trader should consider capital as a tool for growth, not as guaranteed profit.

Money or Capital?

There is an important distinction between money and capital. Money, in its simplest form, is what we use for daily expenses. Capital, however, is money intentionally set aside for investment or business. Treating your trading account as “capital” rather than “money” changes your perspective—you will respect it as a resource to be managed strategically, not spent impulsively.

Trading is Not Gambling

One of the most common misconceptions is equating trading with gambling. While both involve risk, the difference is profound. Gambling relies on chance, whereas trading, when done properly, is based on analysis, strategy, and probability management. A disciplined trader has far greater control over outcomes than a gambler.

Price is the number upon which the buyer and the seller agree as the value of an asset. In other words, both parties reach a mutual understanding that the asset will be exchanged at a specific figure considered its value. This figure is introduced as the price.

Therefore, every trade consists of two events: one purchase and one sale. Without both sides—a seller and a buyer—no transaction can take place. For example, if I am willing to buy your car and even offer to pay more than its actual value, but you refuse to sell, no transaction has occurred. Even if I price your car at one hundred thousand dollars, the car’s price is not truly one hundred thousand dollars until a transaction is made and you agree to transfer ownership in exchange for that amount.

The reverse is also true. If a buyer is willing to purchase an automobile below its actual market value—for instance, offering sixty thousand dollars for a car valued at seventy thousand—the car’s price is not sixty thousand dollars, since the owner will not agree to sell at that figure.

From this, we understand that although buyers and sellers may present their proposed numbers for a commodity, these numbers do not define the price until a transaction occurs. A price is only established when both parties accept the terms of the exchange (the type of asset and its price).

Last Best Price

Consider the following table: as shown, in all financial markets, no transaction occurs unless a buyer and a seller face each other and reach an agreement. The table that reflects this process is called the Last Best Price. At the top of this table, the best prices waiting in line are displayed. (See the next page for the table.)

The Order Queue

In financial markets, there is a trading core where all traders’ orders are lined up in sequence, waiting to be activated. But how is this order determined?

Orders are prioritized according to the best prices. For example, in the upper part of the table—which shows the sellers’ offers—the sequence begins with the lowest price at the top, followed by progressively higher prices. In other words, the more favorable numbers (cheaper prices for buyers) are placed at the head of the line. As we move down the list, we encounter more expensive, less favorable numbers.

Why is this the case? Because naturally, sellers want to sell at the highest possible price, while buyers always seek to purchase at the lowest possible price. Therefore, the most favorable numbers for completing a trade are the cheaper ones, which take priority in the order queue.

For Buyers as Well

It works the same way for buyers. Look at the green section of the table above. Every buyer wants to make their purchase at lower prices. From the sellers’ perspective, the “better” number is the highest bid price, because a seller wants to sell their asset at a higher price. This is shown in the lower section of the sellers’ table, which displays the prices sellers are offering. In the buyers’ list, we also see the highest price at the top, representing the most expensive offer. As we go down the rows, we observe that cheaper prices—meaning worse prices from the traders’ perspective—are placed further down.

Converting Price into Market Movement

We understand that the market mechanism works such that, behind the trading core, in the “last best prices,” prices are arranged from better to worse. Whenever the best sell price meets the best buy price, a trade occurs. The price at which this new trade happens becomes the last price on which a candlestick is built. When the volume at a particular price is exhausted—for example, when 100 units have been bought and sold entirely—the price moves up. This is the point at which an upward candlestick forms, or the current candlestick creates an upper shadow and a bullish move occurs.

Market Depth

The more traders there are sending buy and sell orders to the market, the smoother the price moves, and the easier it is to analyze trader behavior. A market with many participants submitting orders of different volumes at various prices is called a “deep market.” One advantage of this depth is that there are no price gaps. In other words, one reason for price gaps is the absence of orders at certain prices, causing the price to move quickly through those levels.

Some points to consider:

- In the “last best prices,” which are the queues waiting for order execution, only traders and their orders are considered; there is no concept of timeframes in the trading core. It doesn’t matter to the core whether thousands or millions of traders use different timeframes. The trading core only receives the order, sees the price, and places it in the appropriate position in the queue.

- The trading core does not pay attention to any method or tool used by the trader, whether it’s Chartical Jabal Ameli, indicators, or the trader’s analysis. It only considers the volume of buy or sell orders submitted at specific prices and places them in the core.

When the price moves, if the volume at a higher price is fully executed, the price moves upward; conversely, if the volume at a lower price is fully executed, the price moves downward.

So, in the real world, what matters to the trading core is the process of executing orders from thousands or millions of traders—not timeframes, tools, or traders’ analysis. The only important factor is the volume and price levels of the orders, which then determine how buying and selling occur. In the Chartical Jabal Ameli method, the trader should focus on the price itself.

The Nature of the Market

Imagine driving on a road when a deer suddenly crosses in front of you. Should we be upset that the deer is in the road and forces us to slow down or stop? No—humans built roads through animal habitats. The deer is just where it naturally lives; we are the ones who built the road through its environment.

Looking at candlesticks through the lens of candlestick patterns, indicators, or oscillators is similar. Price is like the deer—it is exactly where the trading occurs, not at some percentage or value on an indicator. By observing the price directly, without any intermediaries or shadows, we gain clues about what is happening in the market, giving us at least a step ahead of other traders.

Efficient Markets

One reason we can take advantage of opportunities in financial markets is that we operate in efficient markets. According to Eugene Fama, Nobel laureate in Economics 2013, an efficient market is one with so many participants and so many high-volume trades that the influence of any individual or small group on price changes is minimized—possibly even zero. Moreover, information and news should be released simultaneously and equally so no one can exploit it in advance.

In the Chartical Jabal Ameli method, clues provided by an efficient market allow the trader to quickly determine the direction of price movements. News acts as a catalyst, accelerating price movement in the trader’s favor. Because information is released evenly and traders react quickly, no one can exploit news unfairly.

In efficient markets, price is like a mirror of all underlying events. Observing price directly lets us see the reasons why traders made decisions or changed behavior. This real-time insight is faster and more accurate than relying on indicators or patterns, which often result in delayed reactions and losses.

Random Sequences

Previously, we discussed that in the Chartical method, information is not news or statistics—it is the clues and techniques that help traders understand the flow of orders and liquidity in the market. The goal is to know who is in the market (institutional, professional, or retail traders), their direction, and how long they will stay.

Random sequences refer to situations where similar events occur repeatedly but without a logical reason. For example, flipping coins repeatedly among a thousand people may produce patterns that appear meaningful, but they are purely coincidental. In markets, it is essential to determine whether the techniques we use have a solid scientific and practical basis or are the result of random chance.

Impact of News on Gold (Spot)

Consider the gold spot market. During economic uncertainty, large investors buy gold as a safe haven to protect wealth. The effect of news—such as a China-US trade war, localized floods, or a global pandemic—affects traders differently depending on its scale. Thus, expecting traders to always behave as they did in the past is unrealistic.

Difference Between Traders and Analysts

In trading, you may notice that some people produce excellent analyses but achieve little profit, while others with poor analytical skills may profit greatly. Analysts often justify price behavior with charts, patterns, or scenarios, primarily creating content. Traders, on the other hand, seek high-probability opportunities and focus on entering and managing trades effectively..

Chapter Two: Basic Concepts

According to what has been said, analysis in classical finance falls under a traditional category. In this approach, the individual seeks to justify price movements. While past market movements can easily be explained, how to use that information to determine the current flow of money in the market, which direction it is moving, and how long that money will stay in the market—so the trader can profit from it—is not clear.

Behavioral Finance

In behavioral finance, as defined by modern economic science, the focus of the trader is on the current state of the market and how price changes are occurring—specifically, when liquidity flows are created. Traders who can detect the creation or changes in current money flows in the market no longer need to analyze the market itself; instead, they only need techniques.

In essence, those using classical finance can, at best, create attractive content for social media. However, traders aim to make money from markets, not content. Therefore, one must work with a reliable method that allows trading with any amount of capital and on any timeframe to achieve significant profits. Otherwise, the individual may soon need to change careers.

The difference between analysis and trading is a scientific and highly general issue that has nothing to do with talent, literacy, or skill. Individuals themselves choose whether to be analysts or traders. It is important to note that in the Chartical Jabal Ameli method, no existing type of financial market analysis is rejected. Rather, these methods are excellent for analysis and content creation—but not for making trading decisions that result in buying, selling, or exiting trades.

How Price Action Works in Chartical Jabal Ameli

Until relatively recently, the only knowledge available for trading in financial markets was classical finance. Traders could only rely on analytical methods. Gradually, they realized that even without patterns, indicators, or other existing methods, they could understand price movements. Over time, some individuals abandoned these patterns and indicators.

For the first time in the world, Richard Wyckoff introduced price action based on principles of economics and social sciences. Following that, this knowledge expanded, and more theories were developed.

The U.S. Economic Crisis

During the 2007–2008 financial crisis in the U.S., top economists and analysts gathered to find ways to predict the crisis in advance to prevent losses or even benefit from it. After extensive research, they found that the only effective method was price action. From that time, price action became increasingly popular and scientifically developed among traders.

Interestingly, real price action is based on principles of economics and social sciences. Therefore, real price action does not use any tools, indicators, oscillators, patterns, or even candlestick patterns. Even “price action patterns” have no defined role in real price action, as it focuses solely on traders’ behaviors in the market, without any bias.

From this explanation, it can be inferred that if a method combines tools with price action, it is not real price action, because genuine price action is based entirely on economic and social sciences and deals only with price and its movements. The only thing a trader needs to examine is the price itself.

Chartical Jabal Ameli System

In the previous section, we discussed tension levels, why they occur, and why they are important. In this section, we will focus on identifying important and influential swings.

From this point forward, all points mentioned should be treated like pieces of a puzzle. They must be preserved and combined when entering the market to ensure a successful trade.

All the techniques presented in this chapter should eventually be combined in the trading checklist at the end of this book, forming the ultimate picture—earning profit from trades.

Swing or Tension Level

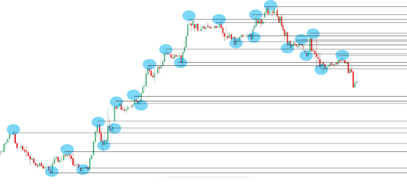

The terms “swing” and “tension level” are equivalent, so we will no longer use both simultaneously. A swing in markets refers to a point where the price changes direction—that is, the price rotates. For example, as shown in the figure below, we have an effective swing: here, the price direction has changed. Before this, the price was moving upward; afterward, it started moving downward.

Pay attention to the next figure. As marked by the red line, there are several swings in this chart. These swings occur because the price was initially moving upward, then changed direction downward, moved upward again, and finally changed direction downward once more.

We understand that any part of the market where the price pulls back and then reverses is called a swing. To identify it, we do not use any specific tools such as technical methods, fractals, or indicators. Instead, we simply observe with our eyes and consider any area where the price has reversed as a tension level.

As seen in the figure above, if we were to plot all tension levels on the chart, it would no longer serve as a trading tool or platform. Instead, it would become like a musical instrument—such as a guitar—that is meant to be played. Amid the cluttered chart, the trader can no longer see what truly matters.

In this context, there is a principle called Troxler’s effect, which comes from the psychology of trading. It states that when we focus excessively on something or search for it too much, our senses become overwhelmed with information, and eventually, we fail to notice what is truly important. Therefore, we only consider effective swings on the chart.

Effective Swing

An effective swing is a swing after which a significant amount of money has entered the market, resulting in notable changes in price movement. For example, in the figure, immediately after the swing, the price reversed and moved upward effectively—making it an effective swing. Similarly, the next swing is also effective because it led to a meaningful movement in price afterward.

In the market, there are also ineffective swings. For example, as seen in the figure, this is not considered a swing because, after it, a significant amount of money did not enter the market.

Based on the concepts discussed earlier and the market book, we understand that all trades occur at the market core. Regardless of indicators, analytical methods, or timeframes, orders line up in a queue, and sequentially, each price level is processed until its volume is exhausted before moving to the next price.

When a price movement cannot continue, it means that there was insufficient buying volume and transaction activity, and no effective money was behind that swing. Therefore, when the price moved upward but stopped immediately, it indicates a neutral movement.

Hence, we only consider swings after which a significant amount of money has entered the market.

Why don’t we draw the swing and only consider it? Because in trading, you don’t need to draw anything. It is enough to identify the swing based on the last few candles you see on the chart—approximately the last twenty candles.

Note that it is only after the last swing that the price begins its effective decline. Therefore, an effective swing is considered a swing in which there is a sufficient amount of money, and the market and its traders demonstrate a meaningful movement.

Sometimes, there are shadows in the market that raise the question for traders: should we consider the swing including the shadow or excluding it? For example, in the figure, you can see several effective swings, but what role do the shadows play in these swings?

Many times in the markets, due to various reasons—such as the release of news related to a symbol, or political, military, social events—we observe large shadows. These shadows can be so large that they are inconsistent with the size of other shadows in the market context. As mentioned before, what the trader sees in the market context is important, not the past of the market. Therefore, if a candle is unusually larger than the average size of other candles in the market context, it can be inferred that it was created by the “frogs.”

A Persian proverb says: “When a city has no sheriff, the frogs become gunmen.” The same principle applies in trading markets: when large traders are absent, small traders become influential.

If you drop a single drop of ink into a full swimming pool, how much impact does it have compared to dropping the same drop into a glass of water? In the trading markets, it works similarly: the ink drop represents the influence of small traders, while the glass or pool represents the presence or absence of sufficient large traders. So when large traders are absent, the trades of small traders affect the market. Once their money runs out or false excitement dissipates, the large traders return to the market, and that movement becomes a shadow—all those moves and trades reverse, leaving nothing behind except the shadow.

This is why such shadows should not be considered. Shadows should be conventional and proportional to the average size of candles in the market context. That is, if you see an unconventional shadow that significantly differs from other candles, it should be ignored.

Drawing Swings

At the beginning, it might be necessary to draw these tension zones a few times until you can observe them visually in the market context without the need for drawing. This will allow you to monitor price reactions in these areas and train your eyes and mind.

To draw these zones, simply mark the region with the highest candle overlap and engagement, where the market has rotated, but use the minimum possible thickness, as shown in the figure below.

As seen in the figure, neither the thickness nor the height of the box matters. The goal is simply to indicate that there is a zone of tension and engagement between traders, which ultimately led to a price reversal. We need to monitor this area so that when the price reaches it again, we can observe traders’ reactions. The conditions for breaking these levels will be discussed in later chapters.

Note: You do not need to draw all levels. Only the effective swings, and among them, just the nearest ones are required. The levels drawn in this figure are for instructional purposes only.

Static and Dynamic Zones

In the Chartical Jabal Ameli method, static and dynamic levels are the same as tension levels, which we call key zones.

Static and Dynamic Key Levels

As mentioned earlier, every group of traders is part of a trading community. When their community collectively faces tension, their options become limited, and the probability of predicting their future behavior increases significantly. According to the figure, zones on the chart that lie on a flat level are called static key levels.

In the Chartical Jabal Ameli method, the way a trader uses these two types of zones—static or dynamic—makes no difference. The trading rules for static and dynamic zones are not different, and both arise for the same reason.

An important point is that, as shown in the figure, when we draw these zones, we are not looking for support, resistance, channels, or trend lines. Instead, we aim to identify the zones that traders react to with high probability, because if support and resistance truly existed in the market, the price could not continuously move above or below a certain level.

According to Eugene Fama’s definitions, terms like support, resistance, trend lines, and channels are just explanations for price movements. For example, the price rises and reacts at a certain level, and elsewhere it hits another level and reverses. Some traders assume this happens because it is a support, resistance, or channel. However, in the Chartical Jabal Ameli method, the key question is: are these zones truly significant? That is, were they formed not randomly, and if they are significant, what reaction should we expect when the price reaches them?

Golden Levels

Golden levels are similar to static or dynamic levels, but with a phase change. For example, if we see a level in the market that previously caused a downward reaction and pushed the price down, and now the price breaks that level upward, the zone becomes highly attractive to the price. If the price reaches this zone, we can expect a reverse reaction—this time causing the price to rise. This is what we call a golden level, and the price then moves upward with a strong movement or steady, regular candles, but now in an upward direction.

For downward movements, it works in the same way. Before the price reaches the level, it has been rising, but after the breakout—when the price returns to that zone—the price direction changes. Unlike before, the price now enters a downward phase and moves lower.

An important aspect of this phase change, or golden levels, is harmony. As shown in the figure, if the market creates a phase change (golden level), the timing—both before and after the phase change—as well as the price movement in terms of pips or points, should be very close to each other, showing a harmonious phase change on the chart. The distance between them should not be too large.

For dynamic golden levels, just like static or dynamic levels, we observe a market reaction. According to the figure, the price first declined, but after breaking that level and returning to that zone, it shows upward behavior. Here too, as with static levels, price harmony is extremely important for the trader.

We have learned that zones on the chart that are horizontal are called key static levels. If these zones are slanted or diagonal, they are called key dynamic levels. We also learned that if the price breaks a zone, whether static or dynamic, and then returns to that zone, we expect a reversal movement, and these are called golden levels.

The main condition for a valid golden level is the maintenance of harmony within that zone.

If this phase change forms a “elephant and cup” shape, this level is not suitable, because when it forms this shape, it loses its optimality. As you can see in the image, before the phase change, the previous correction and phase change were smaller, but after it, they become larger. Therefore, it is no longer optimal.

In the next sections, we will discuss “Depth” (Deps). Whenever depth is increasing, it means that traders moving in the direction of the trend are weakening. One of the reasons why harmony must be maintained is this issue. Of course, there are other reasons as well. Ultimately, the weight of the order flow in the buying or selling direction changes in a way that it is no longer profitable for the trader to operate in that direction, so we should not trade in that position.

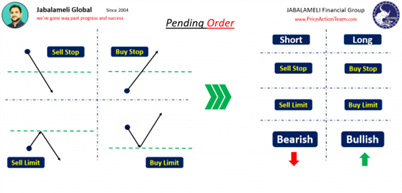

When we want to trade in the financial markets, whether it is a buy or sell trade, there are two situations: the current price is either below or above our expected level. For each situation, we must send the appropriate type of order to the market so that the trade is executed correctly.

First, we will examine the orders that lead to buy trades.

Buy Stop and Buy Limit Orders

In financial markets, we can execute buy trades in two ways: using a Buy Stop order or a Buy Limit order. Each of these must be used in its proper context.

Buy Stop

When the price is below the level at which we intend to enter a buy trade, and we decide that in the future, when the price rises, we want to open a new buy trade, this is called a Buy Stop.

Trading with a Buy Stop order works as follows: the trader instructs their broker, via the trading platform, to execute a buy trade when the price reaches the desired level. The broker executes this order regardless of the timeframe the trader is observing or the reason behind the decision.

For example, if the current price of a stock is $1000, and for any reason, you believe that if the price surpasses $1100, it could accelerate further upward, you can set a Buy Stop order at $1100 with a specified volume. When the price reaches $1100, the broker executes the buy order at that volume.

An important point is that in such conditional orders, your trade will not be activated until the price reaches the specified level. Placing the order does not mean you have entered the market yet. Additionally, when the price reaches the desired level, you do not need to be in front of the computer. You can set an order, and even if you are offline for several days, it will be automatically executed when the price hits the target. From that point onward, market fluctuations will affect your profit and loss, but before that, your account remains unaffected.

Another interesting point is that you can cancel your order at any time before it is triggered.

This describes how a Buy Stop works; however, trading with a Buy Limit order is slightly different.

Buy Limit

A Buy Limit order is used in the opposite situation. Here, the current market price is higher than the level at which the trader intends to buy. In the previous scenario, the trader believes that if the price rises to a certain level above the current price, it will continue to go higher, so they place a Buy Stop to follow the upward momentum.

In contrast, a Buy Limit order is used when the trader expects the price to fall to a lower level first and then reverse upward.

Buy Limit

In contrast, a Buy Limit order works the other way around. Based on the trader’s data and analysis, regardless of the timeframe they are observing, they want to buy if the price drops below the current market price and reaches a specific level. This is because the trader assumes that the price will not go lower than this level, making it the lowest possible price in the market, and allows them to execute a buy trade at the most favorable price.

For example, if the current price is $1000 and the trader believes that in case of a decline, the price will not fall below $800, they can set a Buy Limit order at $800 with a specified volume. When the price reaches $800, the broker executes the buy order.

In general, Buy Stop and Buy Limit orders are instructions that traders send to their brokers via the trading platform to execute trades at specific levels and prices.

- Buy Limit: The current market price is above the desired buy level. The expectation is that if the price drops to this level, it will not fall significantly further and will start moving upward. The trader instructs the broker to execute a buy trade once the price reaches this level.

- Buy Stop: The current market price is below the intended entry point. The trader waits for the price to rise to their target level to execute a new buy trade.

Short Selling (Sell/Short Orders)

Traditionally, profit in financial markets comes from buying a stock, contract, or asset and selling it later at a higher price. In modern financial markets, traders can also profit from price declines.

Sell trades allow traders to profit when they expect the price to fall. Once a trader identifies a level where they believe the price will not rise further, they instruct their broker to sell at that price. The greater the price decline, the higher the profit. In Persian, this is called معاملات فروش or استقراضی, and in English, it is referred to as a Sell or Short order.

Short (Borrowed) Orders

Short orders work by borrowing an asset to sell it first and later buying it back at a lower price.

Example: Suppose you expect gold prices to decline. You borrow 1 kg of gold from a friend, sell it at the current price of $1000, and later buy back 1 kg at $900 to return to your friend. The difference of $100 is your profit.

Financial brokers operate similarly. They lend you stocks or assets based on your account balance and margin. For instance, if you borrow 100 shares, you sell them, wait for the price to drop, buy them back at a lower price, and return them to the broker. The difference between the sell and buy price is your profit, calculated once the position is closed.

Trading Orders

To execute a trade, traders must send orders to the broker. These orders come in different types, depending on the situation.

Sell Stop

In a Sell Stop, the current market price is higher than the price at which the trader wants to sell. The trader instructs the broker to execute a sell trade if the price falls to a specific level. This order reflects the trader’s expectation that the price will continue its downward trend.

When the price moves down and reaches the Sell Stop level, the broker activates the trade. The trader expects the price to continue declining, and they profit from the price difference in the downward movement.

Sell Limit

Another type of trading order is the Sell Limit. A Sell Limit order is used when the current market price is lower than the level where the trader wants to sell. The trader expects that once the price rises to this specified level, it will reach a maximum price or market ceiling and then start declining.

In other words, the trader instructs the broker to execute a sell trade only when the price increases to the target level, because they anticipate that the price will not go higher than that point, and the market will reverse downward afterward.

Example to Clarify

To make the concept clearer, consider this example: Imagine that a trading instrument in the past reached a price of $1000, and then dropped sharply to $700. Now, after some time, the price is around $970, approaching that previous high.

Some traders, expecting the price to react as it did before, may want to sell at this level. However, the price has not yet reached $1000. They have two options: either monitor the chart until it reaches that level, or set a Sell Limit order at this price and continue with other tasks.

Conditional Orders

In general, Sell Limit and Buy Limit orders fall under the category of conditional (pending) orders. These are not executed immediately in the market but are triggered only when the price reaches the specified level. If the price never reaches that level, the order remains inactive.

Closing Sell (Short) Positions

Every sell position requires an opposite order to close it, which is called Buy to Cover. This works as follows: a buy order is executed in the market with the same volume as the original sell, which closes the trader’s sell position.

- It doesn’t matter whether the trader is in profit or loss; closing is always done via a Buy to Cover order.

- In some markets, like Forex, the trader can simply click “Close”, and the broker automatically executes the opposite transaction.

- In other markets, such as cryptocurrencies, the trader must manually issue a buy order of equal volume to close the position.

Important Notes on Conditional Orders

- Chartical Jabal Ameli Method: Traders are recommended to use Sell Stop and Buy Stop orders rather than Limit orders. This is because the method relies on observing market volume, and Limit orders do not provide sufficient visibility for high-confidence reversal trades.

- Entering Trades: In Chartical Jabal Ameli, traders wait for confirmations before entering, which reduces risk. Limit orders would require entering without confirmation, which increases risk.

- Execution Speed: Pending orders are placed directly on the broker’s server, so they execute faster than immediate market orders, where data must travel from the trader’s computer to the broker and then to the market.

Number of Candles Required for Market Reading

A very important point is determining how many candles a trader should have on their chart to make the best decision for taking a trade according to the Chartical Jabal Ameli method.

Zooming the Market Chart and Candle Quantity

In psychology, there is a component called historical memory, which also applies to trading. Traders must understand how to use it to achieve the best results. To illustrate, consider the following examples:

Imagine a couple in the early years of marriage who try to surprise each other on various occasions—anniversaries, birthdays, Valentine’s Day, etc. Over time, however, they gradually forget some dates, not because of lack of love, but because new, more significant events dominate their attention—having children, career achievements, buying a house or car. The same applies to traders in the market: their decisions are influenced by historical memory. Past events affect current decision-making because they are remembered and used as a reference.

Similarly, traders need to consider past candles to make informed decisions.

Recommended Number of Candles

In the Chartical Jabal Ameli method:

- Maximum: ~60–70 candles.

- Minimum: even 20 candles are often sufficient to:

- Decide whether to trade in the market.

- Determine if the position should be long or short.

- Plan exit strategies.

Using more than 60–70 candles can expose your analysis to obsolete information that no longer impacts current market participants.

Chart Zoom

It is recommended to:

- Zoom in the chart to the maximum level.

- Then, reduce it by two levels.

This ensures that candle placement is optimal for market observation. Candles should not be:

- Too large → triggering unnecessary fear or excitement.

- Too small → making it hard to detect shadows and subtle price movements.

Traders should focus on what current influential market participants are observing, not dead information that no longer affects price action.

Rule of Invalid Levels

Not all levels in the market are valid, and you do not need to wait for reactions at every level.

When Levels Become Invalid

- Consider a level that price has broken once to the downside. This is called a breakout.

- When this happens, all Sell Stop and Buy Limit orders in that range are activated.

- Later, if the price moves upward and breaks that level again, all Buy Stop and Sell Limit orders are activated.

As a result, no more pending orders remain in that level. Any reaction observed afterward is random, and relying on it for trading is unreliable.

Swing Reactions and Trading Orders

In the image above, after a strong price move, a correction has formed. The last peak on the left side of the chart is significant for many traders:

- Some traders wait for the price to reach the last peak to buy.

- Others, believing the price has already dropped from this point and will not rise further, wait to sell at that level.

In the market, traders have different mindsets and methods. In Chartical Jabal Ameli, the key point is that both types of orders are activated when the price reaches the range of the last swings.

As the market continues, if the price drops for any reason and then returns to that point:

- Buy Limit orders (expecting the price will not go lower) and

- Sell Stop orders (expecting the price drop to continue)

will both be activated.

Implication: All possible types of trading orders at this price level—based on the last swing—have been triggered. No further price reaction should be expected at this level in the future.

In simple terms:

Once the price passes through a range twice, that swing becomes invalid, and the level no longer matters for trading. From then on, the trader should focus on newer swings where pending orders have not yet been activated.

This highlights that financial markets are extremely dynamic. Price movements continuously create new swings and patterns. A trader who does not analyze the market based on financial logic and practical knowledge may mistakenly believe every movement is meaningful and has a specific reason, leading them to seek rules and trade according to false assumptions.

Market Text (Framework of Market Information)

In the Chartical method, we have learned:

- How to identify market swings.

- Why these swings are important.

- Which swings are relevant for trading and which are not significant.

The market text refers to everything observed on the chart of a trading instrument:

It is the total number of candles used to identify clues and apply techniques to predict the market’s future with the highest probability.

In other words, market text = the visual information on the chart that guides the trader in decision-making according to the Chartical Jabal Ameli method.

Market Text Framework – Highest and Lowest Effective Swings

For example, consider a chart where we identify one swing at the highest point and one swing at the lowest point. This means there are two effective swings in the market text—the highest and the lowest.

Although other swings may exist between these extremes, the focus is currently on the highest and lowest. This range is called the Market Text Framework.

Application in Chartical Jabal Ameli

When a trader wants to make a market decision:

- Suppose they are looking to sell and the price is near the lower boundary of the market text framework. Although the market may show clues suggesting a sale could be profitable, these are often false signals, and entering a sell trade here is likely unsuccessful.

- Conversely, if the price reaches the upper boundary, buy signals may appear, but a purchase should not be made. This upper boundary is a critical tension level, capable of significantly affecting price behavior. Any apparent buy clues here are false signals, and a trader should instead consider selling.

A professional trader always seeks entry points where large or institutional traders—the ones who drive trends—are entering or have recently entered.

- If the price has traveled a long distance from one end of the chart to the other, large traders have likely already entered at better points, meaning they either cash out part of their positions at this level or observe retail traders buying at worse prices to gradually liquidate their positions.

Expert Insight

According to Warren Buffett, trends often form at points unnoticed by most people, including many intelligent traders. New and strong trends typically emerge at levels that 90–95% of traders do not expect, leading the majority to act in the opposite way.

Key takeaway:

- The Market Text Framework is the range between the highest and lowest effective swings.

- At the upper boundary, a trader should not buy.

- At the lower boundary, a trader should not sell.

- Following the actions of major traders is crucial for success.

Trend Formation

In the Chartical Jabal Ameli method, trends are formed by:

- Large traders or a collective of many medium and small traders who together have enough capital or market influence.

- Small retail traders alone cannot create trends.

When large or diverse groups are absent, the market becomes volatile and erratic, and trading in such conditions—either buy or sell—typically leads to losses. Traders may attempt revenge trades or use strategies like hedging or martingale, which are risky.

Thus, identifying liquidity in the market is essential. Success in financial markets depends less on having large funds or analytical knowledge and more on acting on valuable information earlier than others.

Trend Initiation

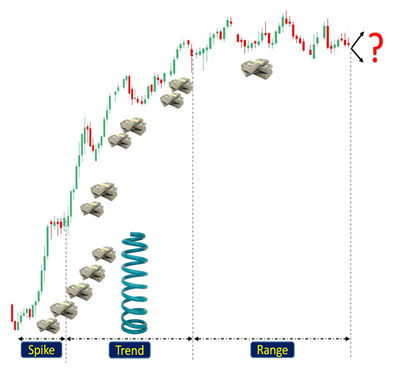

Like all events, trends do not appear suddenly—they have a starting point.

- Traders do not need multiple higher highs or lower lows, multiple touches on channel boundaries, or an indicator breakout to identify a new trend.

- Entry should occur when other market participants are willing to buy or sell at worse prices out of eagerness or pressure. Entering at this stage allows the trader to profit as price moves in their favor.

In Chartical Jabal Ameli, trend identification does not rely on indicators or patterns. Instead, professional traders are recognized by:

- Fewer confirmations needed for trades

- Stronger, more reliable market clues

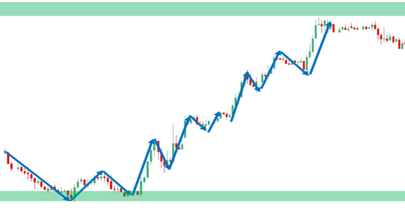

Every price movement observed in the market is referred to as a “leg”

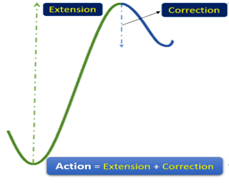

Legs, Extensions, and Corrections

For example, in the chart above, all marked points represent legs of price movement, each with distinct characteristics.

- Extensions:

Legs that are strong, large, and move more smoothly with more candles are called extensions.- Definition: An extension is a strong leg of price movement.

- Corrections:

Legs that are weaker, smaller, with fewer candles, or that move more slowly are called corrections.- Definition: A correction is a weaker leg with shallower movement and fewer candles.

Important Note:

- Weakness is a defining feature of a correction,

- Strength is a defining feature of an extension.

In the schematic below, you can see:

- The larger and stronger part of the movement is the extension (also referred to as a “leg”),

- The smaller movement, usually with a gentler slope, is the correction.

Trends and Market Movements

We have understood that trends are created by large traders or an aggregation of many traders. The core principle of profiting in financial markets is having knowledge and awareness before others. A trader should always look for clues to identify the strength or weakness of market participants, one of which is the observation of extensions and corrections.

Uptrend (Bullish Trend)

To identify a trend, price movement needs to be observed. A trader must align with large traders and big money in the market. This does not mean simply following higher highs or higher lows, or noticing an upward-sloping trendline or channel formed after three or four touches, or an indicator breakout. These are patterns almost all traders can recognize.

Some very important principles form the foundation of our method:

- Nothing in the market occurs instantly. Every beginning has reasons and signs.

- For an uptrend to form, a price movement upward is required.

- For a price movement, extensions and corrections are necessary.

We have learned that:

- An extension is a strong leg of the market movement.

- A correction is a weaker retracement.

- The attributes of strength in extensions and weakness in corrections are extremely important.

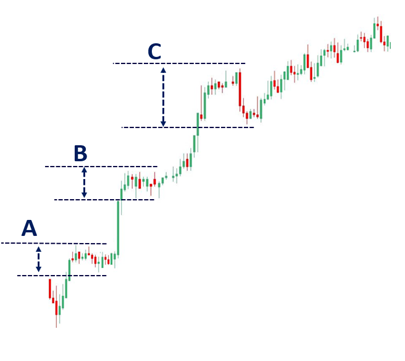

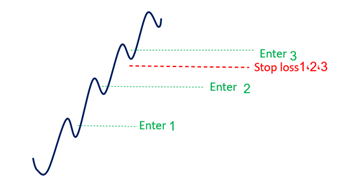

In the Chartical Jabal Ameli method, whenever a strong upward extension is followed by a weak downward correction, a bullish movement is established. As long as this sequence of extension followed by correction continues to repeat, the uptrend persists.

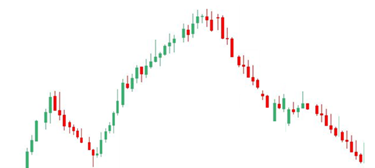

As seen in the image, after the first extension and correction, we observe another extension and correction in the same direction, indicating that the trend continues. Subsequently, another extension followed by a correction occurs in the same direction, showing that the trend is still active.

As long as extensions and corrections continue in the market, the trend persists. A trader should not rely on indicators or levels formed in the market, such as Fibonacci levels, but should instead follow the price action itself. However, to enter trades with higher confidence, a trader should not necessarily enter on every extension or correction.

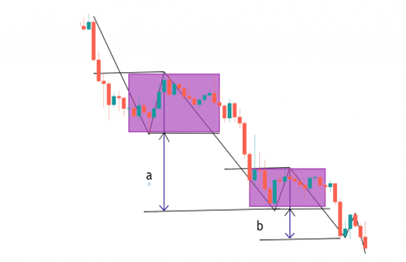

Downtrend (Bearish Trend)

In the Chartical Jabal Ameli method, for a downtrend to form, there must first be a downward movement, preceded by an extension toward the downside and a correction against it.

As shown in the image, to observe a downward movement, we need a downward extension followed by a weak correction. This forms a downward movement. As long as these extensions and corrections continue, the downward movement and trend will persist.

In this section, we have become familiar with two types of trends: upward and downward, which are composed of extensions and corrections. As long as these extensions and corrections continue in one direction in the market, the trend will continue. This highlights the importance of being able to follow the trend from its first move.

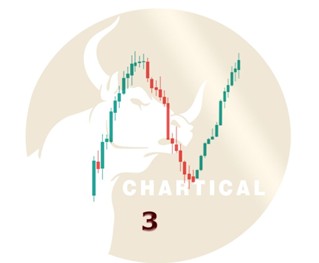

Trend Ending

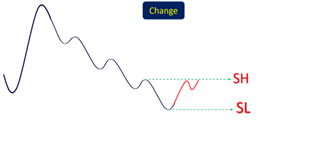

In the Chartical Jabal Ameli method, to determine the end of a trend, whether upward or downward, attention must be paid to the latest swings.

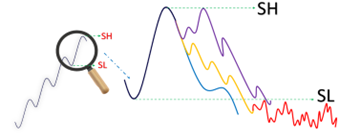

Look at the image: the movement circled shows the last upward price movement, which is formed from the last major swing lows that led to the highest and most recent swing highs. When the price breaks the major swing of the trend downward in any way, the upward trend comes to an end.

As shown in the image with different colors, from the last swing highs to the last swing lows, the price may have moved in any way. It does not matter whether the price made this movement all at once or made several attempts in different forms between the swing high and swing low. The only important point is that the last swing low, which led to the highest and most recent swing highs, is broken by the price.

The End of a Trend Does Not Mean a Reversal

It is possible that immediately after the end of a trend, the opposite trend does not start. In other words, we may not observe downward extensions or corrections, and the price could move in a choppy or ranging manner.

For a downward trend, the same principle applies. The price may continue making movements to decline. Therefore, whenever the last swings leading to the lowest and most recent swing lows are broken by the price in any manner, the downward trend has ended.

This break can occur in two movements, or, as shown in the image, in one movement. Even if the price ranges in between, the trend is considered ended once the swing low is broken.

We have understood that it does not matter how the last swing of a trend is broken. The only important point is that the last swings leading to the lowest and most recent swing lows are broken by the price.

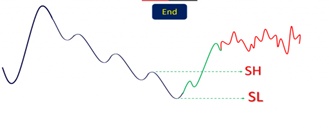

Trend Change

As we have learned, in the Chartical Jabal Ameli method, for the end of a trend—for example, an upward trend—it is necessary that the last swing low, which led to the highest and most recent swing highs, is broken by the price.

However, for a trend change, it is enough that between those two swings, a strong downward extension and a correction against it occur. In such a case, the upward trend ends, and a downward trend begins.

According to the definition of a trend, for a trend to form, the price must first make a movement, which requires a strong extension followed by a correction. In other words, the trader can recognize a trend change even before the last swing is broken.

Please refer to the image below:

In the image above, for a downward movement, we have a downward extension followed by a correction against it.

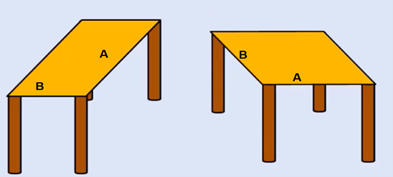

An important point is that the price must correct more than 55–60% of the extension in order for it to be considered a valid downward extension. By “correction percentage,” we mean that if the difference from the swing low to the swing high is, for example, 100 pips, the price must move more than 50 pips downward in a single extension to qualify as a downward extension. After this, one should wait for a correction against it to confirm that the uptrend has changed into a downtrend.

For a downtrend, it works in the same way. To shift to an uptrend, we need an upward movement, which consists of an upward extension followed by a weak correction against it. Whenever we observe in the market that the price between the last swings, which formed the lowest swing low, creates an upward extension followed by a correction, the downtrend has ended and an uptrend begins.

It is important to understand that the end of a trend does not necessarily mean a trend reversal. In summary:

- When the last swing low in an uptrend is broken, it marks the end of the uptrend, and the trader should no longer look for buying opportunities to continue the previous trend—at least until the market situation becomes clear.

- If a strong downward move occurs with a depth greater than 50% of the previous movement, followed by a weak correction in the opposite direction, a new trend may begin.

Range Areas and Principles for Identifying Them

Previously, we learned about trends and realized that sometimes trends end and sometimes they change. For example, an uptrend may eventually, after forming the last swing, enter a range.

In general, a ranging trend (or sideways trend) does not have a specific direction. Unlike an uptrend, where price moves upward with strong upward extensions followed by weak downward corrections, or a downtrend, where all movements point downward, a sideways trend moves more horizontally and without a clear direction.

Sideways Range (Sideway)

Sometimes, market makers or liquidity providers are not given specific instructions to push the price to a particular level. Instead, they maintain the price within a specific range.

As shown in the image below, these participants trade within swings by buying at the lower part of the market range and closing or selling at the upper part. They create fluctuations and maintain the price within the boundaries of the market text (the observable price range).

In the Chartical Jabal Ameli method, this type of ranging market is called a sideway (Sideway range). A sideway is a type of ranging market where liquidity is present, meaning that influential traders are active, but they do not want to push the price dramatically to much higher or much lower levels.

In a sideway market, the price can move in various ways:

- In one scenario, as shown in the image above, the market text may start moving from top to bottom or bottom to top and include several extensions or corrections.

- Another scenario is that in the same market text, the price may rise with two upward extensions and fall with one downward extension.

The main point for traders is that there should be enough distance between the two edges of the market framework to:

- Enter a trade with a defined stop-loss,

- Gain a trade with minimal cost but maximum potential profit,

- Ensure that the distance between the swing low and the swing high in the market text is sufficiently profitable for entering a trade.

The sufficient distance depends on the trader’s timeframe and the price volatility. This means that the trader should pay attention to which timeframe they are observing and what level of volatility exists in that timeframe.

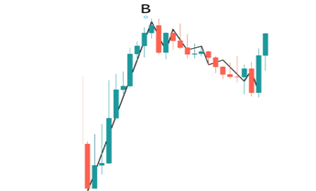

How to Identify a Sideway Range

One way to detect a sideway market is:

- If the price forms 3 swings between the last swing low and the last swing high, it indicates that the market is entering a range.

Refer to the image below for illustration.

Sideway Range

A sideway range is a type of ranging market where the distance between the market’s high and low is enough to allow a trade to be executed and properly managed. A sideway range has defined highs and lows, so traders can anticipate potential price reactions at these points.

Choppy Range

A choppy range is another type of ranging market, but it is not suitable for trading, because unlike a sideway range, large or institutional traders are not active in it.

- In a sideway range, although large or institutional traders were not given specific orders, the market was still considered suitable for swing trading.

- In a choppy range, not only are institutional traders absent, but even the traders present do not see the market as suitable for entry, so they prefer to operate elsewhere.

As a result, the market exhibits erratic and unpredictable movements, where candles frequently overlap. The absence of large or institutional traders causes the following:

- Price movements are small and directionless,

- Movements are irregular, and upper and lower shadows often cancel each other,

- Unlike a sideway range, where movements from low to high or high to low are clear and structured, a choppy range has compressed and irregular swings.

In other words, in a choppy range:

- It is difficult to find precise entry points,

- Placing a reliable stop-loss is challenging,

- The distance between the high and low of the range is too narrow to be profitable for trading.

This type of range is called a Choppy Range.

As seen in the image above, there is no opportunity to enter or manage a trade. The price movements are so chaotic that it is impossible to define clear entry and exit points, and sometimes the stop-loss levels are not clearly identifiable.

The main reason for this situation is the absence of large traders, which results in insufficient and uncoordinated liquidity, usually caused by the dominance of small retail traders. Therefore, these areas are not suitable for trading.

Due to the completely irregular and directionless movements, this type of range is called a Choppy Range—similar to the turbulence created beneath a helicopter or combine harvester. A professional trader does not trade in such a chaotic market where the main players are absent. There is no reason to act when the major market participants are not present.

- If a trader opens their trading platform and encounters a choppy market, they should simply avoid it.

Whenever the price oscillates within a clearly defined range where there is a trading opportunity, manageable stop-loss, and defined entry/exit zones, this area is called a sideway (parallel) range. Conversely, if the distance between the highs and lows is very narrow or the market is chaotic, the range is choppy.

Note:

- In a sideway range, traders are only allowed to buy at the lows and sell at the highs,

- Traders should use fixed take-profit levels within these zones.

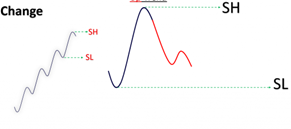

Change and End of Sideway and Choppy Ranges

The change or end of sideway and choppy ranges occurs when market movements begin to show a clear upward or downward direction. In other words, this market state, like other market conditions, is not permanent. The market eventually reaches a point where a strong extension and weak correction can again be observed in the upward or downward direction.

This is similar to what happens when trending markets end: the market continues to move to a certain point, and due to traders taking profits, new entries, or other reasons, the market starts reversing or changing direction.

If you pay attention to the image above, you will notice that the market starts with a sideway trend, continues with a choppy range, and finally ends through an upward movement.

In other words, similar to the end of trends, whenever a strong move occurs in any direction within a range, and the opposite move cannot match its strength and only appears as a weak correction, this acts as a warning signal that the range is ending.

Notice that in a sideway range there is no trend, which is emphasized in the image with a cross mark.

A very important point that every trader should always remember is that in the market, they are looking for the footprints of the big money. Everything that has been explained so far, and everything you will learn in the future, is aimed at finding these footprints.

- Suggestion: It is recommended that learners open their trading platform and, without executing any trades, practice observing the market and applying what they have learned so far in a real market environment.

Chapter Three

Chartical Jabal Ameli: Chartical Clues in Trend Changes

At least once, every trader has experienced a situation where, after identifying a strong trend and entering the market, the price reverses or begins a prolonged ranging movement.

The point addressed in the section on trend-change clues is understanding how long the traders who have created this strong trend intend to remain in it.

Sometimes, what a trader expects from the ongoing trend before entering the market does not happen after the entry. In the Chartical Jabal Ameli method, the trader must pay attention to who is currently active in the market: organizational traders, professional traders, or retail traders? In what direction and with how much capital are they participating? And how long will they remain in the market?

Traders’ Party Analogy

Imagine being invited to a party at a specific time and place. You know the schedule, the hospitality, other guests, and the customs of the event. But if you arrive after the announced time, what happens? Naturally, you find a messy and empty venue—the guests have left, the musicians are gone, the food and drinks are finished, and you have missed all the enjoyment.

This analogy applies to trends as well. Before the trend ends, there is a lot of capital, excellent reactions, and sharp movements. But once the traders who are driving the trend leave the market, entering it is like arriving at a party after it has ended. The participants and activity are gone, leaving only an empty and disorderly scene.

Thus, just as identifying a trend is important, entering at the right time and predicting how long it will last is equally vital. Otherwise, after entering, the price may move against the trend or enter a ranging phase.

Through clues given by candlesticks, by analyzing changes in the flow of orders, a trader can detect this. This does not mean using Steve Nison candlestick patterns; rather, the trader should use candlestick behavior as a record of the actions of influential market participants over specific periods.

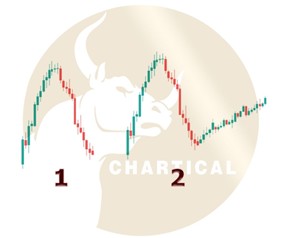

Pay attention to the image below:

When the price moves, it leaves patterns behind, similar to the image above (in financial markets, this pattern is called a candlestick, or simply a candle).

A candlestick can vary in size, length, or even color—for example, some may be green and others red. There is a wide variety of shapes and sizes for candlesticks, but essentially, there are only two colors.

Now, take a look at the chart below, which shows a series of candlesticks.

In the Chartical Jabal Ameli method, regardless of the shape or color of candlesticks, the trader must follow the clues that price action provides. To do this, careful candlestick analysis is required.

Candlestick (Candle)

In general, a candlestick represents a specific time period, with an opening time and a closing time.

- For example, if a trader selects a daily timeframe, a new candlestick forms every 24 hours that the market is open.

- If the trader chooses a one-hour timeframe, a new candlestick forms every hour.

This means that each candlestick on the chosen timeframe reflects all price activity within that period. In simple terms, if a 4-hour timeframe is selected, one candlestick closes every 4 hours, and a new one begins. Each candlestick within that timeframe represents the behavior of traders during those 4 hours.

Open and Close

- Every candlestick has an Open (O) — the price where it starts at the beginning of the time period.

- Example: In a one-hour timeframe, at 10:00 AM, the price might open at $1000.

- Each candlestick also has a Close (C) — the price at which the candlestick finishes at the end of its timeframe. Once closed, the candlestick cannot change, and all subsequent price movement is reflected in the next candlestick.

High and Low

Within a candlestick, there is also a highest price and a lowest price:

- In the Chartical Jabal Ameli method, the highest price is called High, and the lowest price reached in that timeframe is called Low.

Candlestick Color and Trend Indication

- If the closing price is higher than the opening price, the candlestick is bullish (upward) and shown in green.

- If the closing price is lower than the opening price, the candlestick is bearish (downward) and shown in red.

Important: The closing price is the only reference point for decision-making. Observing a candlestick allows the trader to see whether the most recent trader activity in the market was bullish or bearish.

The Four Key Attributes of a Candlestick

Every candlestick has four key prices that are crucial for traders:

- Open – starting price of the candlestick.

- Close – ending price of the candlestick.

- High – the highest price reached during the candlestick.

- Low – the lowest price reached during the candlestick.

When a trader wants to analyze price behavior and look for clues of market changes, they must ask:

- What is happening in the market right now?

- Are the large traders still active?

- If so, will they continue, or when will they enter?

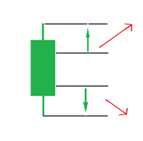

To answer these questions, one must examine the candlestick from its High to its Low, i.e., from the highest price to the lowest price reached during that period. Regardless of the candlestick’s color or shape, the candlestick should be divided into three equal parts, because the closing price in each part has a different meaning.

In the illustration below, these three segments are highlighted.

Close in the Upper Third

If the closing price is in the upper third of the candlestick (the area shown in the illustration below), there is a higher probability that the next candlestick will also move upward in the near future.

Why This Matters for Traders

This information is crucial for a trader because entering a new trade should ideally occur when there is a higher probability of success and minimal capital at risk. The optimal entry point is where the price immediately moves toward the profit zone, so the trader avoids being stuck in a loss or stagnant position and can start gaining almost immediately.

Close in the Lower Third

If the candlestick closes in its lower third (the area shown in the illustration below), there is a higher probability that the next candlestick will move downward. In this scenario, if the trader is looking to enter a sell position, it is an appropriate time to enter the market.

This helps the trader avoid getting caught in the market’s grinding movements. When planning a buy or sell trade, the trader should not enter on every candlestick, because doing so could lead to a trade with high capital at risk. The price might initially move slowly or sideways before reaching the profit zone, and there is also the possibility of having to exit the trade prematurely.

Close in the Middle Third

If the candlestick closes in its middle third, the price is likely to continue moving sideways (range-bound) for one or two more candlesticks. This principle also applies to movements (moovements). When a trader manages open trades, the goal in the Chartical Jabal Ameli method is to maximize the market’s potential. By evaluating the strength of each candlestick, the trader can decide whether it is safe to stay in the trade or if an exit is advisable.

Candlesticks reflect the latest behavior of influential market participants, and traders should use them to guide their trading decisions.

Note: The importance of candlestick closes is not uniform; it becomes especially significant in critical points of the market, such as at the end of corrections or the conclusion of major movements.

Types of Corrections (Carctions)

One of the most important clues in trading is the correction, which provides useful information for trade entries. In the Chartical Jabal Ameli method, corrections come in various forms, which we will explain.

Extensions and corrections in markets are like human breathing. Just as humans need both inhalation and exhalation to live, markets require both extensions and corrections to remain healthy. Whenever the market moves continuously upward or downward without correction, the trader should realize that the current timeframe is not suitable. They may need to move to a higher timeframe, and if the higher timeframe also shows the same behavior, it could indicate that the price is unhealthy or inflated, forming a bubble.

In the Chartical Jabal Ameli method, when markets correct, they create trading opportunities—both for continuation trades and reversal trades. Corrections are essential for market health, and we will discuss them in detail in the following sections.

Types of Corrections

Although corrections are the market’s “breath” and are necessary for its health, the type of correction also provides clues to traders. For example: How much liquidity exists in the market now? How significant will upcoming price movements be? A trader must first become familiar with the different types of corrections in terms of technical characteristics and visual appearance.

Stall Correction

One type of correction is the stall correction. As shown in the illustration, in a stall correction, after an extension is complete, the price cannot retrace more than 15% of the extension, meaning the correction is shallow. For example, if an extension moves 100 pips, the stall correction cannot retrace more than 15 pips (15%), so it does not significantly reverse the movement.

Pressure in a Stall Correction

The pressure present in a stall arises from traders who, driven by stubbornness, desires, and emotions, have invested large amounts at unfavorable levels. According to auction theory, they continuously and aggressively trade, creating a strong force in the market.

Due to the emotional and desire-driven pressure of these traders, the extension is substantial. When the price attempts to form a correction, the liquidity pressure prevents it from retracing more than 15% of the extension distance, resulting in a stall correction. The stall typically lasts 3 to 5 candlesticks. In other words, the pressure must be strong enough that the price cannot remain in that region longer and must continue its movement.

A trader should note that stall corrections form after a spike. The spike represents the first movement (extension) of a new trend, which is very strong and begins with small candlesticks. Gradually, the candlesticks grow larger. This means that stalls can only appear at the beginning of trends. Stalls do not appear in the second or third steps of a movement. If a retracement resembling a stall occurs later in the trend, it is still strong in terms of trader participation, but it does not have the quality of the first step. Such occurrences mid-trend can happen due to false excitement, like a news release.

To identify a stall-type correction, the trader must observe 3 to 5 candlesticks. If the correction lasts more than 5 candlesticks, the movement is considered choppy (disorderly). If it is fewer than 3 candlesticks, it is a normal behavior continuing the extension.

Because of the strong financial determination of the traders creating the extension, when the price attempts a correction, it cannot retrace significantly, usually only up to 15% of the extension, making the stall correction the strongest form of retracement.

The next type of correction is the pullback correction. After the price forms an extension, a correction is expected; however, the maximum retracement of this correction should not exceed 50% of the extension distance.

For example, in an uptrend, if the last extension was 100 pips, the correction should not drop more than 50 pips. If it exceeds this, the movement is no longer considered a correction but rather a new extension. In such cases, if a weak correction is observed, it is expected that the downtrend will continue.

Another type of correction, which is common, weak, and frequently seen in the market, is the simple pullback. A simple pullback means that after an extension, the price retraces between 15% and 50% of the extension.

Why shouldn’t the correction exceed 50%?

Pullback Complex

Suppose that to create an upward extension, the price requires 100 lots or 100,000 contracts to be traded. Naturally, a strong movement has formed in the market, resulting in an extension.

Now, if the price retraces up to 50% of the extension, it can be inferred that the traders who created the extension—whether bullish or bearish—are still at least 50% present, meaning their intent has not changed and the price movement in the previous direction remains strong.

However, if the retracement exceeds 50%, for example reaching 60%, it indicates a significant shift. Using the previous example of 100 units traded (assume these are buy trades), a 60% retracement implies 60 units of selling have entered the market while only 40 units of buying remain. This means a smaller portion of the original extension creators is still active.

Thus, even if a strong move occurred, the nature of the correction is very important. Through this analysis, one can assess whether the larger community of extension creators is still in control. For example, if the correction reaches 60%, the stronger portion is now with the 60% retracement. If a counter-move forms in this scenario—for instance, in an uptrend—then the upward move is no longer dominant, and a downward movement may be forming, or at the very least, the market has entered a range (sideways) phase.

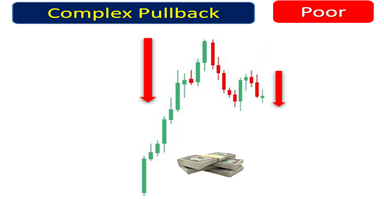

Weak Complex Pullback

The weak complex pullback represents the weakest state of a trend, because the traders who created the extension were not strong enough or persistent enough to maintain control. When the market enters a correction phase, they only allow the price to pull back once, resulting in a single pullback.

In contrast, opposing traders are able to push the price back twice, creating two counter-moves against the original extension. This scenario is referred to as a complex pullback or multiple correction.

As observed in the image above, the price, like in a simple pullback, initially retraces and even appears ready to move again. However, due to either a lack of strong buying from the bullish traders or excessive selling pressure from the opposing sellers, the price fails to resume its upward move and cannot form the next extension. Instead, it falls again. In this case, a complex pullback or multiple correction is formed, indicating either a weakening of the traders in the trend direction or a strengthening of the traders opposing the trend.

In a complex pullback, there are two retracement legs, meaning the price experiences two consecutive pullbacks within the correction.